Your re-finance the financial and you may found a check during the closure. The bill due on your own this new mortgage might possibly be higher than the dated one to of the number of that have a look at, together with home improvement loans interest rates people settlement costs folded with the mortgage.

It’s sorts of including “copying” their mortgage by using out a number of the currency you have paid involved with it and raising the financial dominating owed because of this.

There aren’t any constraints regarding how make use of new proceeds from a profit-aside refinance – it can be used when it comes down to goal you love (however, there tends to be taxation effects – come across less than). A number of the usual ones try renovations or fixes, settling most other bills, degree costs, carrying out a business or scientific costs.

Cash-out refinancing is largely a variety of refinancing and you can a house security loan. You could potentially obtain the money you would like, as with a house security mortgage otherwise personal line of credit (HELOC).

Cash-out refinancing and you may domestic collateral

So you’re able to be eligible for a finances-aside re-finance, you ought to have a lot of family guarantee. That’s what you will be borrowing from the bank against.

Can you imagine you reside well worth $250,one hundred thousand and you also owe $150,000 on the home loan. That delivers your $a hundred,000 home based collateral or 40 % of your own home’s well worth.

You generally need to preserve at the least 20% equity just after refinancing (although some lenders goes lower), with the intention that will provide you with $fifty,100000 accessible to obtain.

So you can borrow you to definitely number, you’d remove an alternate financial getting $2 hundred,100 ($150,100 already due as well as $50,000) and you can discover a $50,100000 examine during the closure. This won’t account for your settlement costs, that are step 3-6 % of your amount borrowed and are have a tendency to folded towards the loan.

Advantages of bucks-out refinancing

- Home mortgage refinance loan prices include below the eye cost to your other sorts of personal debt, so it is a very prices-efficient way to help you borrow money. If you use the money to pay off other expenses such as for instance just like the handmade cards or a home security financing, you’ll be reducing the interest you pay thereon loans.

- Home loan loans can also be paid off more a much longer several months than other form of loans, as much as 3 decades, that it helps make your instalments so much more down when you yourself have a good number of personal debt that needs to be paid in the 5-a decade.

- If field pricing possess dropped because you got out your financial, a money-away re-finance is also let you borrow cash and relieve their mortgage price meanwhile.

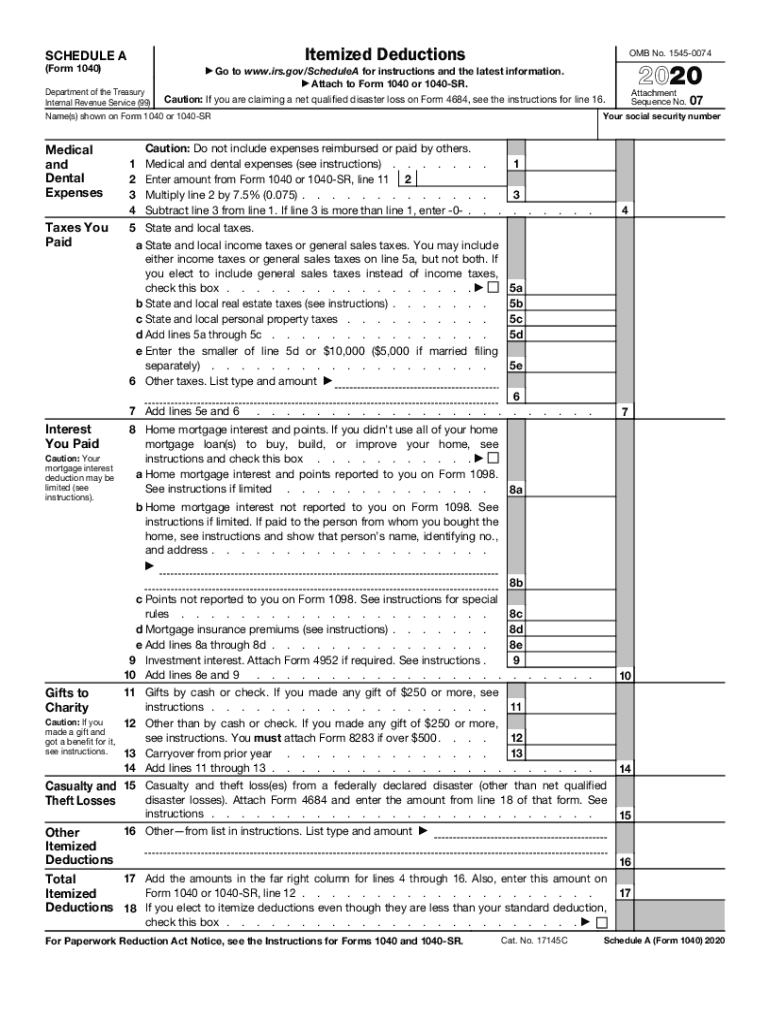

- Mortgage desire could be taxation-deductible, therefore of the running almost every other financial obligation into your financial you might deduct the attention repaid with it to specific limits, as long as you itemize deductions.

When you use the funds buying, build otherwise boost a property, you can deduct financial notice paid into the mortgage concept as much as $one million for a few ($five-hundred,one hundred thousand single). But when you use the arises from a funds-aside refinance for other intentions, eg degree expenditures otherwise paying down handmade cards, the new Internal revenue service treats it as property collateral loan, and you will just deduct the attention on basic $100,100 lent by a few ($fifty,100000 unmarried).

While the told me a lot more than, there are various advantages of refinancing but you need to continue in your mind this lower amounts does not build refinance feasible because of finally settlement costs towards the total amount borrowed.

Downsides of cash-away refinancing

Among the many huge downsides regarding a money-aside re-finance is that you pay closing costs toward whole loan amount. So if you owe $150,one hundred thousand on the financial and rehearse an earnings-away re-finance so you can obtain other $50,100000, you happen to be investing settlement costs off 3-6 % on the entire $2 hundred,000.

Leave a Reply