Were there mortgage brokers to possess unmarried mothers?

While here commonly particular solitary mother or father lenders, there are some financial apps that can meet the needs regarding unmarried moms and dads. This type of funds could help bypass the difficulty out-of lower earnings when buying property due to the fact an individual mother or father.

There are also advice apps to provide money on your deposit, along with homebuyer training software plus one-on-you installment loans in Oakland to counseling to guide you from home buying procedure. On the whole, to buy a home once the one father or mother tends to be smoother than do you think.

Definitely, there isn’t any like thing since a great typical unmarried mother or father. Some are rich, while many work hard to juggle each other childcare and you may their private finances.

When the money’s no problem for your requirements, and you’ve got a 20% down payment towards family you should buy, it is possible to get a conventional financial (that perhaps not supported by the federal government), offered your credit history is compliment therefore don’t possess as well far current loans. Your upcoming step is to obtain a loan provider you love new look of immediately after which get preapproved to suit your mortgage.

However, life’s not like that for the majority single mothers and fathers. You might find one money’s tend to rigorous hence their borrowing from the bank get requires unexpected hits. Nonetheless, you, also, can become a citizen if you learn the best financing system.

Real estate conditions having unmarried parents

The financial would want to ensure you is comfortably afford your own month-to-month mortgage repayments additionally the extra expenditures that come with homeownership. Loan providers assess that cost relating to your current monthly funds, having fun with things entitled the debt-to-earnings proportion (DTI).

DTI measures up your monthly, pre-income tax earnings up against your own constant expenses – as well as your future financial – to ensure that you have enough cashflow to help with an excellent homeloan payment. When your present debts plus your estimated mortgage repayment was inside 43% of one’s revenues, you need to be capable be eligible for home financing.

Because importantly, you will want a good credit history, which could be from around 580 so you can 620 or maybe more situated with the minimal credit history criteria on the financing program you choose.

Solitary mother mortgage brokers

In the event that money’s a tiny stronger on your single money, you may be trying to find an interest rate who’s loose qualification requirements. Fortunately, of several preferred loan applications was flexible in connection with this. Home buyers can choose from an array of lower and you may actually no-down-commission mortgage brokers depending on their needs.

Compliant fund (3% down)

Compliant funds try a type of conventional loan you to adjusts to laws and regulations laid down of the Federal national mortgage association and you will Freddie Mac. You want a down payment regarding merely step three% of the property purchase price and you can a credit history away from 620 otherwise ideal. But you will have to pay personal home loan insurance (PMI) up until you’ve hit 80% family equity

FHA money (3.5% down)

Backed by the newest Government Construction Administration, FHA financing keeps the lowest down payment element step 3.5%. And at 580, the credit get endurance is gloomier than which have compliant financing. Understand that you’ll pay for mortgage insurance fees (MIP) if you don’t offer, re-finance, otherwise spend the money for amount borrowed entirely. Thus, many consumers like a compliant loan in the event that their credit rating is 620 or maybe more

USDA money (no off)

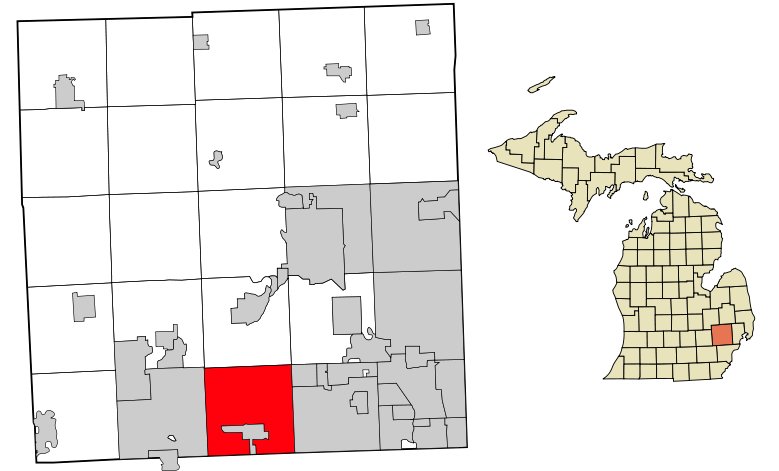

USDA fund is actually supported by this new You.S. Agency off Farming (USDA). No downpayment is required. However have to pick into the a specified outlying town (which includes 97% off America’s landmass) while having the typical otherwise lower than-mediocre earnings into the set for which you need it.

Leave a Reply